Repairing Your Mortgage Credit for people in Alberta

Bad credit rating can be gut-wrenching and humiliating … if you live in Alberta we have options to help you out!

“Life is what happens when you’re busy making other plans.” …and sometimes things get out of control. A bad credit rating can be gut-wrenching and humiliating as well as just plain bad news. We see all kinds of credit ratings every day and we have the strategies to help improve and even heal, damaged credit. You may be surprised to know that you can still obtain a mortgage. Whether you’ve had a bankruptcy or your credit is only slightly bruised, you can obtain financing.

As mortgage professionals, we have access to non-traditional lenders who offer financing solutions to individuals who have some credit challenges that cannot be addressed by the major financial institutions. Together we can quickly assess your situation and decide on the best way to move forward. The worst you can do is do nothing.

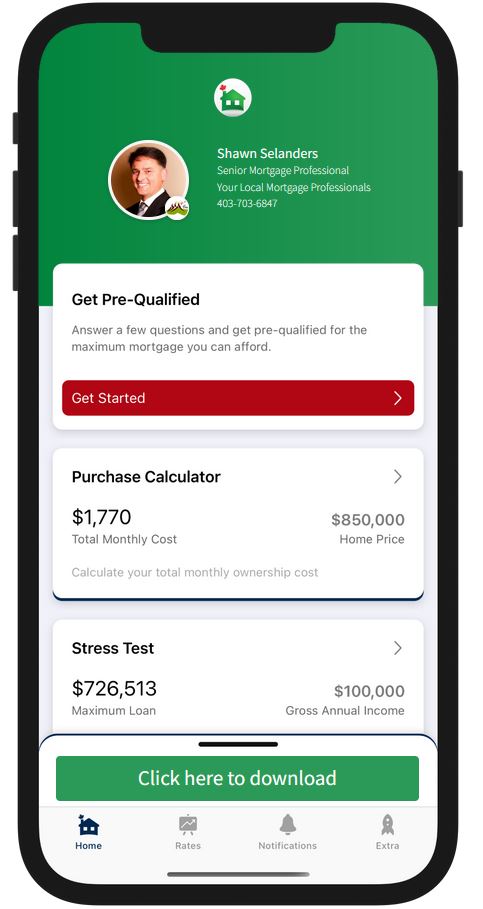

Download Canada's #1 mortgage app today! Access rates and MUCH MORE!

Free Mortgage Evaluation

Quick Mortgage Links

Corporate Office - Your Local Mortgage Professionals

Broker | Copyright © 2016